Quick Answer

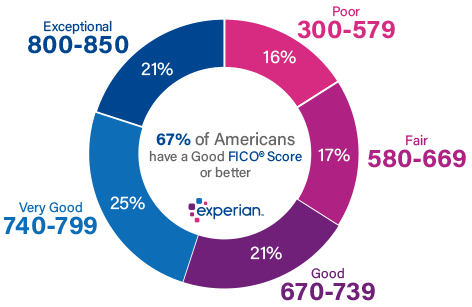

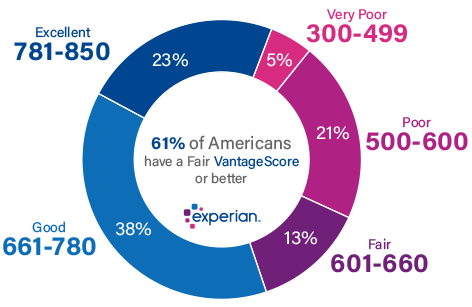

A credit score is a three-digit number calculated from information on a credit report and usually ranges between 300 and 850. A good credit score is 670 to 739 on the FICO ® Score range, while a credit score of 661 to 780 is good on the VantageScore ® series.

A credit score ranges from 300 to 850 and is a numerical rating that measures a person’s likelihood of repaying a debt. A higher credit score indicates that a borrower is a lower risk and more likely to make on-time payments. Credit scores are often used to determine the likelihood that someone will pay what they owe on debts such as loans, mortgages, credit cards, rent and utilities. Lenders can use credit scores to evaluate loan eligibility, credit limit and interest rate.

For a score with a range between 300 and 850, a credit score of 700 or higher is generally considered good. A score of 800 or higher on the same range is considered excellent. Most consumers have credit scores that fall between 600 and 750. In 2021, the average FICO ® score has ☉ in the US reached 714—an increase of four points from the previous year. Higher scores can make creditors more confident that you will repay your future debts as agreed. But creditors can also set their own definitions of what they consider good or bad credit scores when evaluating consumers for loans and credit cards.

This partly depends on the type of borrowers they want to attract. Creditors can also consider how current events may affect consumers’ credit scores, and adjust their requirements accordingly. Some lenders create their own personal credit scoring programs, but the two most commonly used credit scoring models are those developed by FICO ® and VantageScore ® .

What is a good FICO ® score?

FICO ® creates different types of consumer credit scores. There are “base” FICO ® scores that the company makes for borrowers in various industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO ® scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO ® industry-specific credit scores have a different range —250 to 900. However, the middle categories have the same groupings and a “good ” industry-specific FICO ® score is still 670 to 739.

What is a good VantageScore?

VantageScore’s first two credit scoring models had ranges from 501 to 990. The two newest VantageScore credit scores (VantageScore 3.0 and 4.0) use a 300 to 850 range—the same as the base FICO ® scores. For the latest models, VantageScore defines 661 to 780 as its good range.

What Affects Your Credit Scores?

Common factors can affect all of your credit scores , and they are often divided into five categories:

- Payment History : Making timely payments on your credit accounts can help your scores. But missing payments, an account being sent to collections or filing for bankruptcy can hurt your scores.

- Credit utilization : How many of your accounts have balances, how much you owe and the portion of your credit limit you use on revolving accounts all come into play here.

- Length of credit history : This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts : Also called “credit mix,” this considers whether you manage both installment accounts (such as a car loan, personal loan, or mortgage) and revolving accounts (such as credit cards and other types of credit lines). Showing that you can manage both types of accounts responsibly usually helps your scores.

- Recent Activity : This considers whether you have recently applied for or opened new accounts.

FICO ® and VantageScore take different approaches to explaining the relative importance of the categories.

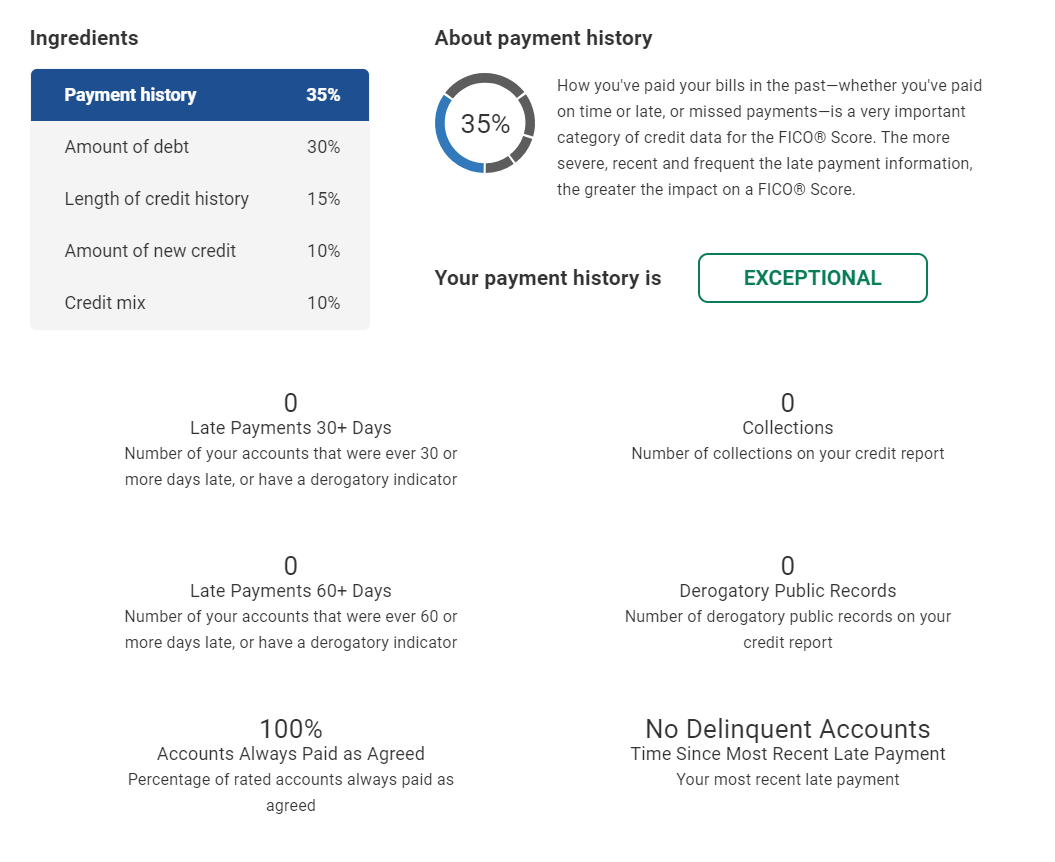

FICO ® score factor

FICO ® uses percentages to generally represent how important each category is, although the exact percentage breakdown used to determine your credit score will depend on your unique credit report. FICO ® considers scoring factors in the following order:

- Payment History : 35%

- Amounts due : 30%

- Length of credit history : 15%

- Credit mix : 10%

- New credit : 10%

Vantage Score Factor

VantageScore ranks the factors according to how influential they are in determining a credit score overall, but it will also depend on your unique credit report. VantageScore considers factors in the following order:

- Total credit usage, balance and available credit : Extremely influential

- Credit mix and experience : Very influential

- Payment history : moderately influential

- Age of credit history : Less influential

- New accounts opened : Less influential

What information credit scores do not consider

FICO ® and VantageScore do not consider the following information when calculating credit scores:

- Your race, colour, religion, national origin, sex or marital status. (US law prohibits credit score formulas from considering these facts, as well as any receipt of public assistance or the exercise of any consumer right under the Consumer Credit Protection Act.)

- Your age.

- Your salary, occupation, title, employer, date of employment or employment history. (However, keep in mind that lenders may consider this information when making their overall approval decisions.)

- Where do you live.

- Gentle inquiries. Soft inquiries are usually initiated by others, such as companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit scores. Soft inquiries also occur when you check your own credit report or when you use credit monitoring services from companies like Experian. These inquiries do not affect your credit scores.

Why there are different credit scores

Credit scores are a tool lenders use to make lending decisions. FICO ® and VantageScore create different credit scoring models for lenders, and both companies regularly release new versions of their credit scoring models—similar to how other software companies might offer new operating systems. The latest versions may incorporate technological advances or changes in consumer behavior, or better meet recent regulatory requirements.

For example, VantageScore creates a tri-bureau scoring model, meaning that the same model can evaluate your credit report from any of the three major consumer credit bureaus (Experian, TransUnion, and Equifax). The first version (VantageScore 1.0) was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and was developed based on data from 2014 to 2016. It was the first generic credit score to include trend data—in other words, how consumers manage their accounts over time.

FICO ® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO ® Score 8. There are two commonly used types of consumer FICO ® scores:

- Base FICO ® scores : These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO ® scores range from 300 to 850.

- Industry-Specific FICO ® Scores : FICO ® creates automated scores and bank card scores specific to auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the particular type of account, and the scores range from 250 to 900.

FICO ® industry-specific scores are built on top of a base FICO ® score, and FICO ® regularly releases new series of scores. The FICO ® Score 10 Suite , for example, was announced in early 2020. These include a base FICO ® Score 10, a FICO ® Score 10 T (which includes trend data) and new industry-specific scores.

There are also scores that are used more rarely. For example, FICO ® is slowly rolling out the UltraFICO ® score, which allows consumers to link checking, savings or money market accounts and take into account banking activity. Lenders can also create custom credit scoring models designed with their target customers in mind.

Lenders can choose which model they want to use. In fact, some lenders may decide to stick with older versions because of the investment that may be involved in switching. And many mortgage lenders use older versions of the base FICO ® scores to meet guidelines from government-backed mortgage companies Fannie Mae and Freddie Mac.

You also often won’t know what credit report and score a lender will use until you submit an application. The good news is that all consumer FICO ® and VantageScore credit scores rely on the same underlying information—data from one of your credit reports—to determine your credit scores. They also all aim to make the same prediction – the likelihood that a person will be 90 days delinquent on an account (either in general or a specific type) within the next 24 months.

As a result, the same factors can affect all of your credit scores. If you monitor multiple credit scores, you may find that your scores differ depending on the scoring model and which one of your credit reports it analyzes. But over time, you can see that they all tend to rise and fall together.

Why it’s important to have a good credit score

In general, good credit can make it easier to achieve your financial and personal goals. It can be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And it can have a direct impact on how much you have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO ® score and a 720 FICO ® score could be $72 per month. This is extra money you can put toward your savings or other financial goals. Over the life of the loan, a good score could save you $26,071 in interest payments.

In addition, credit scores can affect non-loan decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports (but not consumer credit scores) can also affect you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And in most states, insurance companies can use credit-based insurance scores to help determine your auto, home, and life insurance premiums.

How to improve your credit scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are pretty simple:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it will stay on your credit report for up to seven years. If you think you might miss a payment, contact your creditors as soon as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your credit utilization rate is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure that the ones you do open will be added to your credit report. These can be installment accounts, such as student, car, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which can hurt your credit scores a bit. The impact is often minimal, but applying for many different types of loans or credit cards in a short period of time can lead to a larger score drop.

Other factors can also affect your scores. For example, increasing the average age of your accounts can help your scores. However, it is often a matter of waiting rather than taking action.

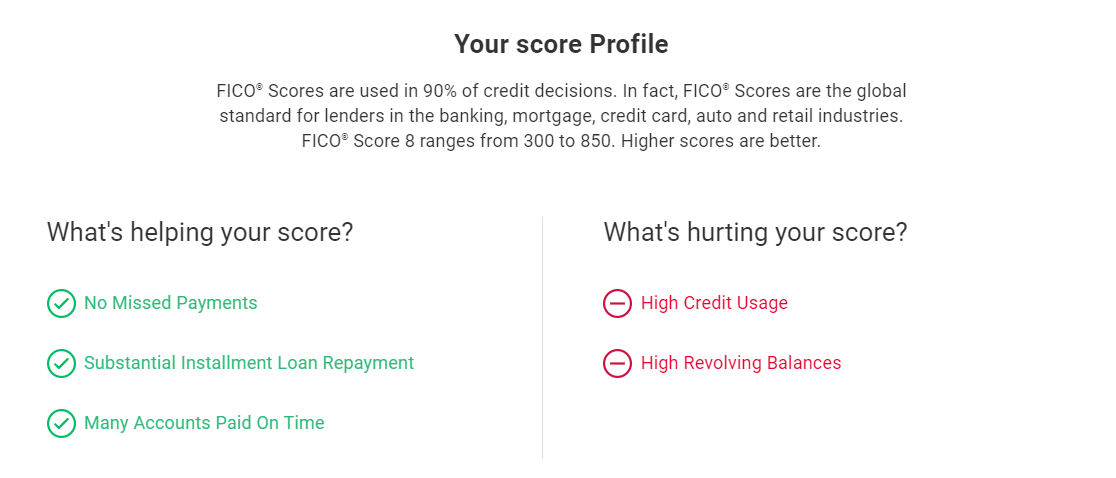

Checking your credit scores can also give you insight into what you can do to improve them. For example, when you check your FICO ® Score 8 from Experian for free, you can also see how you’re doing in each of the credit score categories.

You’ll also get an overview of your score profile, with a quick look at what’s helping and hurting your score.

What to do if you don’t have a credit score

Credit scoring models use your credit reports to determine your score, but they can’t score reports that don’t have enough information.

For FICO ® scores, you need:

- An account that is at least six months old

- An account that has been active for the past six months

VantageScore can log your credit report if it has at least one active account, even if the account is only a month old.

If you can’t get points, you may need to open a new account or add new activity to your credit report to start building credit . Often this means starting with a credit building loan or secured credit card , or becoming an authorized user.

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not unusual for scores to move up or down throughout the month as new information is added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying off a high credit card balance and lowering your utilization rate can increase your score.

But some actions can have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, can lead to a drop in your scores, even though this is a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left with a mix of open installment and revolving accounts, or with only high balance loans.

Maybe you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but a lack of activity in your accounts can lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

Keep in mind that credit scoring models use complicated calculations to determine a score. Sometimes you may think that one event increased or decreased your credit score , but it was a coincidence (for example, you paid off a loan, but your score actually increased due to a lower credit utilization ratio). A single event is also not worth a certain number of points – the point change will depend on your entire credit report.

For example, a new late payment can lead to a large point drop for someone who has never been late before, as it can signal a change in behavior and, in turn, credit risk. However, someone who has already missed a lot of payments may experience a smaller point drop due to another late payment because they are already assumed to be more likely to miss payments.

How to check your credit score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores , including a variety of free options.

Your bank, credit union, lender or credit card issuer can give you free access to one of your credit scores. Experian also allows you to check your FICO ® score 8 for free based on your Experian credit report.

The type of credit score you get can depend on the source. Some services can provide you with a version of your FICO ® score, while others provide VantageScore credit scores. In both cases, the calculated score will also depend on which credit report the scoring model is analyzing.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks℠ Premium membership, you can get your FICO ® score 8 scores based on your Experian, Equifax and TransUnion credit reports – plus multiple other FICO ® scores based on your Experian credit report.

Monitor your credit report and score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable terms—but checking it further ahead of time gives you the chance to improve your score and potentially save hundreds or thousands. dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there is a suspicious change on your report.

Keeping track of your score can help you take steps to improve it so you increase your chances of qualifying for a loan, credit card, apartment or insurance policy—all while improving your financial health.