In today’s world, we are all looking for instant gratification. Despite knowing that patience and discipline can yield better rewards, we still want to achieve all our life goals in the shortest possible time. The same is true for investments. We want to get the maximum profit in the shortest possible time. That is why we are always on the lookout for the best investment plans that can double or triple our money.

While there are specific investment plans that can help you grow your money, finding those investment products can be a daunting task. Plus, they may take longer than you think to produce the desired results. Therefore, to successfully grow your wealth, you need to align the available investment plans with your investment horizon and the risk you are willing to take.

One way to choose the best investment plans for your portfolio is to divide your financial goals into 3 buckets: long-term, medium-term, and short-term. By doing this, you will get an idea about the time you have in your hand to achieve the goal. After that, you can choose from the available options according to your risk appetite.

This blog will look at some of the most popular Indian investment options that fit into these 3 buckets, i.e. long-term, medium-term, and short-term. More importantly, we will explain how you can combine multiple investment options to create the best investment plan for yourself.

Best Investment Plans For The Long Term

Long-term goals are those you want to achieve in the next 7-10 years. Therefore, when you look to choose the best investment plans for the long term, you can go for options that are volatile but have the potential to deliver high returns over the long term.

That said, you need to decide what kind of volatility you can ride and choose your investment options accordingly. Let’s look at some of the investment options that may fit your long-term investment goals, the risks they carry, and the returns they can provide.

Direct Equity

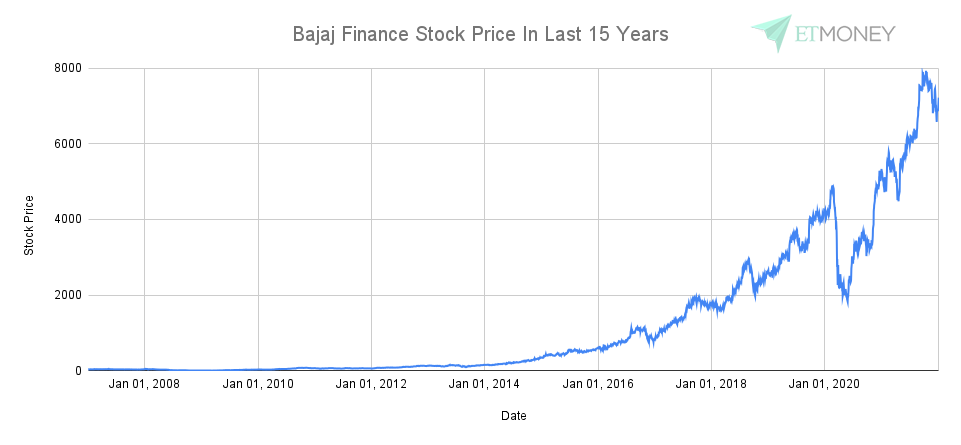

One of the best ways to create wealth for your long-term goals is to invest in equities. There are many examples of stocks that have multiplied investors’ wealth over time. For example, Indian non-banking financial company Bajaj Finance has delivered an annualized return of over 41% over the past 15 years.

To put this return in perspective, an investment of Rs. 10,000 in Bajaj Finance in Jan 2007 will be more than Rs. 18 lakh in Jan 2022. This means your investments have grown 180X times.

To put this return in perspective, an investment of Rs. 10,000 in Bajaj Finance in Jan 2007 will be more than Rs. 18 lakh in Jan 2022. This means your investments have grown 180X times.

Many more stocks like Bajaj Finance have emerged as wealth creators for investors. But at the same time, there are many companies that have become wealth-destroyers. Take, for example, Reliance Communications. Its stock prices have risen 98-99% from their peak in January 2008. And investors in these stocks have witnessed the erosion of their wealth.

In sum, while stocks have tremendous potential to grow your money over the long term, the risks of investing in stocks are also significant.

You can directly invest in stocks of companies. But the real challenge is finding the right stocks. And since there are more than 5,000 stocks listed on the Indian Stock Exchange, choosing the right stocks is definitely a difficult task.

Equity Mutual Funds

One way to reduce the risk of avoiding wealth destroyers is to get professional help and diversify your investments across multiple stocks. Equity Mutual Funds can be found here.

Equity Mutual Funds primarily invest in stocks. But they don’t focus your money on just 1 or 2 stocks. These funds diversify your investments across multiple stocks. Above all, professional fund managers run these funds. So they invest your money only after adequate research. As a result, it increases your chances of getting good returns in the long run.

Here are some popular categories of Equity Funds and their long-term performance.

| Name | 5 Year Return (%) | 10 Year Return (%) |

| Large Cap | 16.8 | 14.92 |

| Large and MidCap | 17.06 | 17.83 |

| Flexi Cap | 16.98 | 16.38 |

| Mid Cap | 18.22 | 20.83 |

| Small Cap | 20.07 | 22.02 |

| ELSS | 16.75 | 16.97 |

Real Estate

It is certainly one of the most popular investment options among Indians. However, while property investments have delivered spectacular returns in the past, it has its own set of risks and limitations. One of the main risks in real estate is that you may not be able to sell it in a short period of time. And in a rush to sell the property, you may have to sell at a deep discount.

Plus, even if the money you need is smaller than the property, you have to sell the entire property to get the money.

gold

Gold has been a symbol of wealth since ancient times. And even today, it still doesn’t lose its luster as an investment option that can beat inflation.

Physical gold has been the traditional way to buy the yellow metal. But it comes with limitations such as extra labor or design charges or storage costs. To overcome these limitations, you can buy gold through Mutual Funds and ETFs. We have a blog that explains various Gold Investment Options in India . Read on to find out which one is best for you.

As far as returns from Gold are concerned, historically, Gold has not delivered as high returns as equities for a long time.

| Return Comparison (Gold vs. NIFTY 200 TRI) | ||

| Investment Period | Gold Returns (%) | NIFTY 200 TRI Returns (%) |

| 5 years | 1.4 | 9.1 |

| 10 years | 8.8 | 14.1 |

| 15 years | 11 | 14.25 |

However, the price of gold usually rises when people look to invest in safe-haven assets in the midst of crises. So they are a good hedge against inflation or Equities.

Small Savings Schemes Like PPF

The government has introduced many small savings schemes for people who want to invest in highly safe investment options. These schemes offer assured returns to investors with little volatility. But you earn lower returns than market related products like NPS, Mutual Funds or stocks.

That said, small savings schemes usually beat inflation and FDs by a decent margin. Examples of small savings schemes for the long term include investment options such as Public Provident Fund (PPF), Senior Citizens Savings Scheme (SCSS), Sukanya Samriddhi Scheme, and Kisan Vikas Patra.

The following table shows some of the small savings schemes suitable for long-term investment and the returns you can get from them.

| Instrument | Interest Rate | Frequency Integration |

| Senior Citizen Savings Scheme | 7.4% | Quarterly and Paid |

| Public Provident Fund Scheme | 7.1% | Years |

| Farmer Vikas Patra | 6.9% | Years |

| Sukanya Samriddhi Account Scheme | 7.6% | Years |

NPS

The National Pension System (NPS) is a long-term investment product focused on retirement. It is a mix of different assets such as equities, government bonds, and corporate bonds. You can decide how much of your money to invest in different asset classes based on your risk appetite.

ULIPs

A Unit-Linked Insurance Plan (ULIP) combines life insurance and investments. A portion of your premium is invested in asset classes such as equity and bonds to build wealth over the long term. Another part of your premium goes towards a life insurance cover.

In the past, ULIPs were notorious for high charges. However, the new ULIPs do not have such high charges. But they still come with a lock-in of 5 years. You can read our blog Mutual Funds vs. ULIPs to find out which option suits you best.

Best Investment Plans For Medium Term

Medium-term goals are goals that are 3-5 years away. For example, medium-term goals could be saving for your wedding, a house downpayment, home renovations, etc.

For such medium-term financial goals, you need investment options that can beat inflation by a decent margin, and at the same time, they should not be too volatile. Here are some investment options that can fulfill your long-term financial goals.

National Savings Certificates (NSC)

The National Savings Certificate or NSC is a post office savings product supported by the Indian government. It works like a 5-year FD. So your NSC deposits will mature in 5 years, and you will earn 6.8% annual interest. But the full amount will be paid only at maturity.

So, if you have a goal of 5 years away, NSC is one of the safer investment options. But it comes with limitations like 5-year lock-in and poor returns compared to Debt Funds or Hybrid Funds.

Post Office Time Deposit

Like banks, post offices also offer FDs. Known as Post Office Time Deposit, these investment options allow you to deposit your money for short-medium time periods. The advantage of Post Office Time Deposits is that they offer better returns than banks. And that too without any additional risk as these schemes are backed by the government of India.

Here is a table showing the returns from Post Office Time Deposits for different time periods.

| Tenure | Post Office Time Deposit Interest Rate | SBI FD Interest Rate |

| 1 year | 5.5% | 5% |

| 2 years | 5.5% | 5.1% |

| 3 years | 5.5% | 5.3% |

| 5 years | 6.7% | 5.4% |

Debt Funds for the Medium Term

There are as many as 16 types of Debt Funds. All these categories of Debt Fund vary in terms of the level of risk they take and the rate of return they aim to generate. So, you need to be sure of your goals to choose the right Debt Fund for you.

There are three categories of Debt Mutual Fund that hit the sweet spot between risk and return for a medium-term goal. The three categories of this Debt Mutual Fund are Banking & PSU Fund, Corporate Bond Fund, and Short Duration Fund. You can read our blog The Best Debt Mutual Funds For 3 Years to know why these 3 categories of Debt Fund are best suited for your medium-term goals.

Hybrid Funds

These types of mutual funds invest in more than one asset class. The most popular combinations of asset classes used by these funds are Equity and Debt. But some Hybrid Funds also invest in Gold or even Real estate. The advantage of these funds is that you can enjoy the growth potential of equity and the stability of debt in a single fund.

Best Investment Options For Short Term

When you are looking for the best investment plans for short term, you need to consider 2 important aspects. First, you need to minimize the risk to the capital invested. And secondly, your investments should be easily accessible. Let’s look at investment options that can accomplish these two goals.

Bank Fixed Deposits (FDs)

It is one of the most popular Indian investment options as they offer guaranteed returns. The way FDs work is quite simple. You deposit your money in the bank, which ensures you a certain return on your principal investment at the end of tenure.

While FDs are one of the safest investment options, they have some significant limitations. Post-tax returns from FDs have barely kept pace with inflation. This means that if you are investing in FDs, you are essentially earning negative returns and losing your wealth over time. Also, FDs impose a penalty if you withdraw your investments before their maturity. So liquidity of FDs is also a significant limitation.

Short Term Debt Funds

Liquid Funds, Ultra-Short Duration Funds, and Money Market Funds are the 3 categories of Debt Funds suitable for your short-term investment basket. These are very low risk products. And they also offer better accessibility to investments than traditional products like FDs. You can read more about these 3 categories in our blog Best Types of Mutual Funds for Short Term Investment .

How to Find the Best Investment Plan?

All the investment products we have discussed so far have different levels of risk and try to achieve different rates of return. None of the investment products is an all-in-one solution to all your investment needs. To achieve your goals, you need to carefully build a portfolio of multiple investment products based on your risk profile, investment horizon, and return expectations.

However, it is never easy to know your risk profile, the suitable investment options, the right exit strategy, etc. You need an expert’s ongoing advice to deal with these important investment decisions.

So whether you have short-term goals, medium goals, or long-term goals, Genius will first understand you as an investor and assess your risk-taking capabilities.

After that, Genius creates portfolios that match your risk score. You get exposure to Indian and international equities, debt, and gold in these portfolios. Allocation to these asset classes is decided based on many market factors such as inflation, valuations, and price trends. Moreover, Genius tells you exactly what changes you need to make to your portfolio each month. The suggested changes help you take advantage of prevailing market conditions and get consistent market-beating returns. The best part is that it all happens seamlessly, and you complete the rebalancing with one tap.

Genius’ intelligent personalization, asset allocation and monthly rebalancing methods help you earn high returns with high consistency. You will also enjoy better protection during market corrections. One sign is that Genius portfolios delivered 80% more than their benchmark while offering 40% better protection during the worst market downturns.