A payment gateway is an online service provided by software companies in collaboration with financial service providers such as Visa and Master Card that enables a website to accept electronic payments. In India, payment gateways are offered by private banks such as ICICI Bank, HDFC Bank and Yes Bank, along with international players such as Paypal. A payment gateway consists of a secured encrypted connection that is created between your web portal and the commercial bank. It enables a business to get money into its chosen bank account through different channels such as a credit card, debit card, internet banking, prepaid cards and mobile wallets.

To put it simply, a payment gateway is a secure page where you enter the details of your financial instrument and complete the transaction.

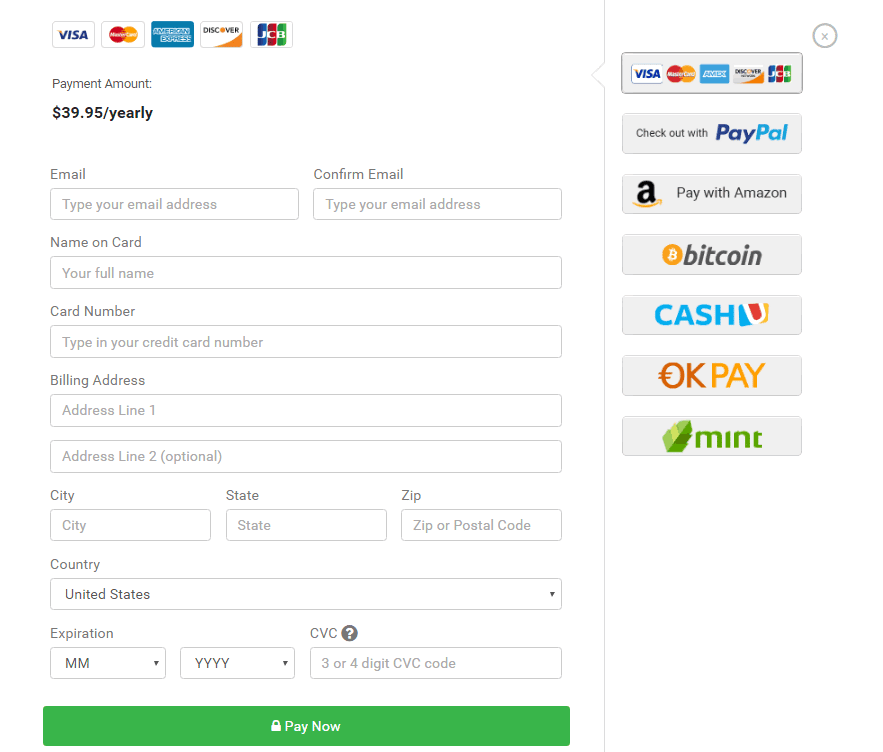

What a Payment Gateway looks like on a website.

You will need to set up a payment gateway if you want to accept payments online. If you are a popular blogger , you don’t need a payment gateway unless you plan to sell digital goods and services on your blog.

With growing cybercrime, it is important to choose the right solution provider so that you do not suffer any financial loss due to fraudulent transactions. If you are an individual who only wants to accept payments in your own name, you should instead just opt for a digital wallet like Paypal .

Payment gateways in India have witnessed high growth in recent weeks due to the demonetisation of high value currency notes of Rs 500 and Rs 1000 . With only Rs.100 and less denominations in circulation, many entrepreneurs have signed up to accept digital payments. Some services like Instamojo even offer a free signup bonus of Rs 500 to every new user.

To encourage the adoption of digital payments in India, the Reserve Bank of India has announced discounts on service charges along with the temporary waiver of service tax. Government has also through RBI reduced the Merchant Discount Rate (MDR) for transactions up to Rs 2000 till 31st March 2016. So this is the best time to start your website as you will save a lot of money on transaction charges. Once your website is set up, you can easily learn how to acquire new customers by completing these free online courses on Digital Marketing . Then you are ready to start building your online empire.

The heart of every online business

Payment gateways are the heart of any online business without which no digital transaction can take place. India is in the midst of an internet boom which has seen internet users grow to around 350 million currently and this user base is expected to touch 600 million by 2020. So it is important to choose your solution provider after doing thorough research with a long term done considered.

An online payment service provider can be evaluated on the following parameters:

- Payments accepted : Whether the gateway accepts credit cards, debit cards, internet banking and other new options such as Bitcoin. The more options you have, the greater the chances that the sale will be completed.

- Failure Rate : All payments go through various hiccups like downtime, OTP delays and failure to verify. So ask your developer to evaluate gateways on failure rates.

- Costs : A payment gateway and bank account usually cost you anywhere between Rs 10,000 to Rs 50,000 in setup costs, along with incremental payments of an average of 2% on each transaction. You will typically be charged additional fees for any of the refunds. There are two fees you will be charged for each payment program – bank fees and payment gateway fees. However, there are many free options also available in the market where setup fees are waived.

- Plugin compatibility : Some of the popular payment service providers offer easy-to-integrate plugins that are easy to maintain and update.

- Payment Cycle : The payment can take anywhere from 2-10 days to be credited to your bank account once processed. To inquire about their payment schedule.

- International and domestic cards : Most payment service providers have different products for domestic merchants and international merchants. If you want to accept foreign currencies, the cost will usually be higher.

- Customer Service – You can no doubt expect to encounter fraudulent activity on your website at some point. Stolen card details and passwords are used by cybercriminals to purchase legitimate goods. So you will need to contact their customer support to resolve these issues. So it helps to inquire and determine if their customer service is efficient and timely.

Now that you know what a payment gateway is and how to choose one, check out some of the companies listed below:

Top Payment Gateways in India

Zaakpay

Zaakpay is a startup that currently powers over 500 merchants and claims to have done over 1 billion transactions internationally. The company has the stated objective of streamlining payment transactions in India. Founded in the year 2011, Zaakpay has two major products to offer merchants – Webpay and Bankpay. It also has different offers for mobile (Mpay) and web (Webpay) platforms. You can accept payments in various currencies such as Euro, Dollar and Rupee. Customers gave high ratings to their services and praised the fast merchant approval rates.

Another interesting feature of their services is the T+1 payment cycle. In such a settlement cycle, you receive digital payments in your bank account on the second day after the payment is made on your website. Other companies are known to take 3-5 days to process your payments

Features of Zaakpay:

- 100% online registration and approval process. No physical documents required.

- Accept payments through Net banking, Debit and Credit cards.

- Supports all Indian and International Visa, MasterCard, Discover and American Express cards.

- More than 52 Indian banks are supported by Net banking services.

- Customized payment streams for your customers and high transaction success rates.

- Easy to integrate with intuitive dashboards. APIs enabled that can be easily scaled up.

- Provide payment settlement cycles of T+1 and T+2.

- Has multi-currency support along with the ability to store card details.

- Facilitate automatic payment retry and customized reporting.

- Integration plugins are available for almost all PHP and Javascript based content management systems. This includes WordPress, Drupal and Joomla. Works well with Java and .Net based platforms.

- Have 24×7 email support through the contact form, chat and email.

Maximum transaction discount rate (TDR) for transactions varies around 3%. THE lowest TDR for credit card and debit card is 2.25%. They have setup fees ranging between Rs.10,000 to Rs 30,000.

CitrusPay

CitrusPay facilitates digital payments and online payment processes for over 800 million strong electronically connected user base. CitrusPay was founded in 2011. It has emerged as the preferred choice of millions over the years and has an admirable list of clients. It also counts legendary Silicon Valley billionaire Peter Thiel as one of its investors.

It offers a single management panel in which a layout of user-friendly checkboxes helps you enable or disable payment options and refund trades. It offers excellent customer service and has won rave reviews from different customers across various geographies. CitrusPay also allows users the freedom to opt for EMIs while making payments.

CitrusPay has one of the lowest service costs in the industry; they charge a flat 1.99% + Rs. 3 for every transaction done by them. CitrusPay also charges Rs. 1,200 as an annual maintenance fee. Their superior infrastructure results in a very high conversion rate for merchants. For large merchants, the company has a steady payment service with a set-up fee charged. For all transactions, the merchant must pay 2.9 percent of the sale proceeds as a fee. However, it does not charge any setup fees to small traders.

Benefit

Established in the year 2012, Emvantage claims to have a very high transaction success rate. It offers users extensive options and also enables them to use prepaid cards and newly launched Rupay debit cards. High-level security and user-friendly interfaces enhance its appeal to Geeks.

- Offers ready to integrate features for 3D Secure.

- Supports QR code based processing options.

- It provides ready options for integration with IMPS and UPI Interface.

Transaction charge on debit card and IMPS is 1.5%, and on Rupay / Master / Visa / net banking it is 2.75%. The international transactions will set you back 3.25%. Transaction cost on EMI is 1.5%. There are no setup costs with this payment gateway. Amazon acquired Emvantage for an undisclosed amount in early 2016 and plans to use it to expand its user base among Indian e-commerce sites.

Pay with Amazon

Launched in the year 2007, Pay With Amazon allows websites to accept payments from Amazon customers using their payment information stored in their accounts. Amazon has millions of customers worldwide, so you can integrate their solution if you want to target this segment of the population. If you choose their payment solution, you are also backed by their modern logistics service called Amazon Easy Ship . In a country like India where delivery of goods is a major pain point due to misleading addresses, these services are a Godsend.

Pay With Amazon has waived all setup and monthly charges until September 30, 2017 as part of the promotional offer. They currently charge 1.95% of the sales volume to merchants based in India.

2Checkout

Founded in the year 1999, 2Checkout payment gateway is a global leader in payment services and exploits online sales conversions by providing global buyers with different payment options. Used by more than 50,000 merchants, 2Checkout provides transactions in 196 different countries through 8 payment methods, 15 languages and 26 currencies, thus creating one of the leading processors of virtual transactions around the world. The plugin is compatible with over 100 different Checkout Cart software.

Unique Features :

- It offers multilingual dealer support via phone, online booking, email and tickets.

- Has a full suite of analytical software and statistics built into the merchant administration.

- It offers recurring and one-time billing options.

- You don’t have to wait long to get funds in your bank account as it has daily payouts.

A 1.5% fee is charged on payments you receive from customers. In the event of a refund, a $25 fee will be charged. There are no hidden fees and no additional costs for fraud protection. You only have to pay for what you use.

E-Billing Solutions (EBS)

E-Billing Solutions (EBS) is a payment gateway established in the year 2005 headquartered in Mumbai. It was one of the first Indian companies to enable online purchases from a dealer’s website. EBS is compatible with most of India’s leading banks such as HDFC, AXIS Bank , SBI, OBC, Canara Bank and Syndicate Bank. They offer a 14 day money back guarantee if you are not satisfied with their services.

Transaction rates for online banking and credit cards range from 2.75% to 3.75%. For debit card transactions, EBS charges 1.25% to 1.50% commission. A small setup fee of Rs. 11,999 and annual maintenance fee of Rs. 2,400 must also be paid. Recently they launched a ” Zero Setup Fee Plan” for online payments with multiple currency processing options.

Brain tree payments

Founded in the year 2007 and having more than 100,000 users, Braintree is a subsidiary of PayPal. Braintree is popular among entrepreneurs for its simple integration, numerous payment options, modest pricing, security and support. They charge a transaction fee of 2.9% + 30 cents for most transactions. An additional 1% fee is charged on transactions obtained outside of your own currency. A flat $15 fee is deducted for any chargebacks that may occur. Reduced rate of 2.2% + 30 cents is available to qualified nonprofits. There are also no setup costs for NGOs.

Juno Payments

Juno Payments is an international leader in offering payment solutions. It has deployed customized solutions globally for e-commerce and mobile enterprises. Founded in the year 2012, its services have been widely adopted by government departments and educational institutions in the United States and Europe.

Some important points about their product

- It can be set up instantly and integrates with Quick-books and other accounting software

- Has high level Enterprise level security. Data collected by Juno-payments is kept in a data vault where it is encoded with tokens and protected against hackers. Has the highest security features among all providers.

- Special packages and discounted rates for non-profit organizations.

- Is a diversified company with diverse ERP products and customized mobile payment solutions for industries across verticals.

Juno Payments ensures direct operator billing and it works even when the user is offline. It is the only payment gateway that provides carrier billing access to the entire mobile user base, when using service on 2G/3G/4G or on WiFi and also when the user is off data. This removes the requirement for an OTP to validate any transaction initiated from the mobile – error-free and secure.

Instamojo

Founded in 2012, Instamojo is a multi-channel payment gateway that allows freelancers and small businesses to collect payments online with the help of just a single link. Whether you are a beginner or just a freelancer looking to sell digital products, Instamojo is the best choice for your needs. It has more than 150,000 active users and reaches out to 1.5 million users.

Review of Instagram

- You can upload digital products like e-books, photos on their website and accept payments through Instamojo’s gateway. The entire sale from collection to delivery of digital goods can be completed through a streamlined dashboard.

- There are no setup fees and it takes 5 or at most 10 minutes to setup and accept payments. However, there are some limits which can be removed by verifying your Pankart and Bank account details.

- Google Analytics integration is allowed.

- You can make a discount code for your specific product and use it to promote your products.

- You can allocate separate commission for separate affiliates.

Instamojo charges a transaction fee ranging from 2% to 5% per sale. There are no setup fees, no maintenance fees and no minimum commitment. Instamojo has quickly emerged as the alternative choice to Paypal for Indian freelancers.

Razorpay is a new entrant to this market and it simplifies the flow of online payments through a clean, easy to use and developer friendly interface. It was founded by alumni of IIT Roorkee in the year 2013 and has an active base of more than 10,000 users.

USP’s:

- RazorPay has mobile SDKs for iOS and Android.

- It has a powerful mobile API that can be used with your mobile website.

- It can support different payment methods and accepts international payments.

- There is no redirection. You can start and end payments on the same page without transferring customers to different pages.

- RazorPay is integrated with 3D-Secure and Verified by Visa (VBV). All necessary redirection is controlled within a popup. It also accepts Rupay debit cards managed by NPCI.

- It can be embedded into your website using easy-to-generate code. You don’t need to know programming or web development.

It has announced a limited time offer of 0% TDR charges on debit card transactions till December 31, 2016. After the expiry of this offer, it will charge 2% for every successful transaction on national and international cards. It also charges 3% on Diners, American Express and EMIs. These charges include service tax.

It has a customized plan for newly incorporated companies called ‘ The Startup Plan’ , which only processes domestic payments, has no setup or annual fee, and charges 2.5% + service tax for every successful transaction completed. The business plan for established companies is able to process international payment charges at Rs 5000 setup fee and a Rs 5000 annual maintenance fee.

With our review complete, it’s now time to announce the winners for 2017. Before deciding on the winners, we interacted with various startups and retail consumers and asked for their opinions on all the companies listed above. Based on their feedback, our evaluation, market share, scalability, user cost, online reviews, features, user interface and customer experience, we would like to announce EBS, Instamojo and Citrus Pay as the top three payment gateways in India.